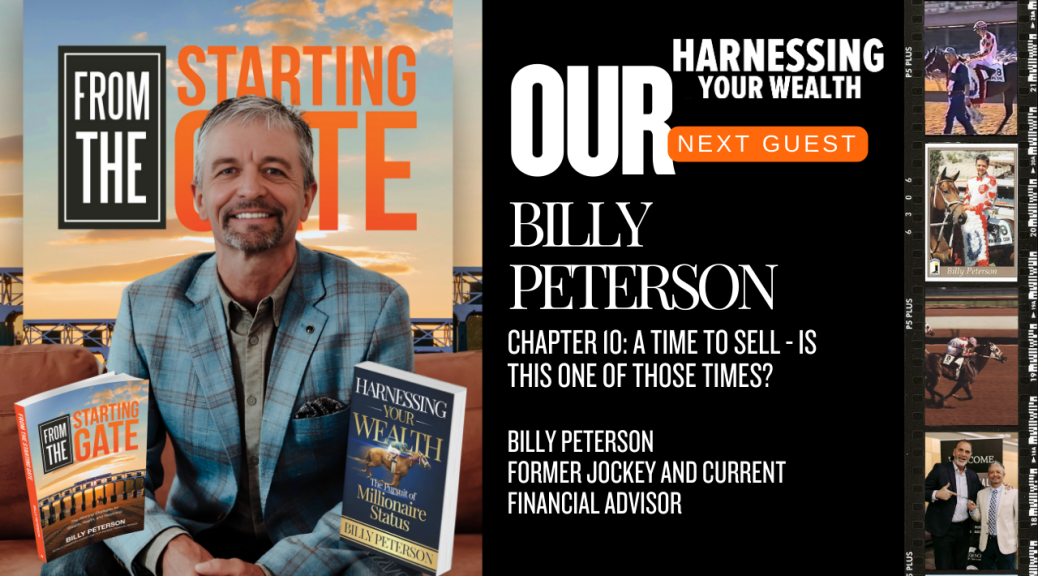

Bulletproof Wealth: How to Secure What You’ve Built (EP. 63)

In this episode of Harnessing Your Wealth, we discuss the importance of protecting wealth, especially in blended families, and the role of trusts in safeguarding assets for future generations. Billy, Shaun and Cade open conversations about inheritance and financial planning to prevent conflicts among family members. The discussion also highlights the significance of having a solid financial plan to ensure long-term success and stability.

Takeaways

- Prenuptial agreements are essential for protecting assets in blended families.

- QTIP trusts can help safeguard children’s inheritance in blended families.

- Trustees should be chosen carefully to avoid family conflicts after death.

- Estate planning is especially important for blended families to consider all parties involved.

- Teaching children the value of money can prevent them from squandering their inheritance.

- Having a financial plan helps individuals understand their goals and resources.

- Open discussions about wealth can strengthen family relationships.

Resources & Previous Episodes of Interest:

- Get a copy of Billy Peterson’s books here!

- From the Saddle to Success: Billy Peterson’s Journey (EP 36)

- 10 Essential Steps to Guide Your Children Toward Financial Fulfillment (Ep. 38)

- Navigating the Economic Landscape of 2025 (EP 47)

Connect with Billy Peterson:

Connect with Shaun Peterson:

Connect with Cade Peterson:

Podcast: Play in new window | Download | Embed