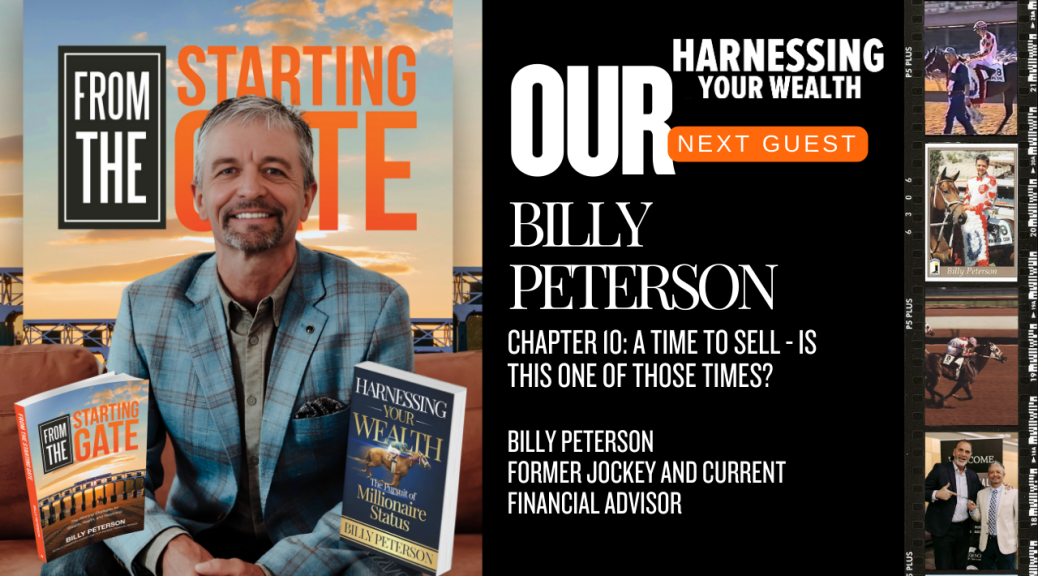

Chapter 10: A Time to Sell – Is this one of those times? (EP 53)

In this episode, Billy takes the hot seat as his son Cade interviews him about key concepts from his book, focusing on market volatility, goal funding in retirement, emotional investing, tax strategies, and performance-based selling. The conversation emphasizes the importance of understanding market dynamics and making informed decisions rather than reacting emotionally to market fluctuations. In this conversation, the speakers discuss the implications of wealth loss, government accountability, and the importance of long-term investing strategies. They emphasize the need for taxpayers to be aware of government actions and the impact of economic decisions on personal finances. The discussion also highlights Warren Buffett’s investment strategies and the significance of patience in investing, particularly during market downturns.

Takeaways

- Market volatility can create both opportunities and challenges for investors.

- Rebalancing is essential to maintain your original investment allocation.

- Goal funding is crucial for retirement planning and should be approached strategically.

- Capitulation often leads to poor investment decisions driven by fear and greed.

Previous Episodes of Interest:

- Cody Jensen’s Winning Formula Horse Racing (Ep. 39)

- Chasing Glory: Inside the Gates of the Saudi Cup – Racing for $20 Million (Ep. 33)

- From Drywall to Derby: Pierre Amestoy’s Journey into Horse Racing (Ep. 17)

Connect with Billy Peterson:

- Peterson Wealth Services: Billy Peterson

- LinkedIn: Billy Peterson

- Instagram: petersonwealthservices

- billy@petersonws.com

- 801-475-4002

Connect with Cade Peterson:

Podcast: Play in new window | Download | Embed